Accueil »

Cover pool

Eligible assets

Caisse Française de Financement Local’s assets comprise exclusively:

- exposures to public persons eligible under Article L.513-4 of the French Monetary and Financial Code and Article 129 of CRR: these are loans or bonds with or fully guaranteed by public persons (States, local and regional authorities, groups thereof or public establishments) of a Member State of the European Union

- exposures to French public sector entities not complying with Article 129 of CRR and exposures to public persons of a non-EU Member State, which were marketed by the former shareholder of CAFFIL and are now managed in extinction. Thus, since 2013, the new assets of the Caisse Française de Financement Local only concern French borrowers.

- sufficiently secure and liquid securities, exposures and deposits (replacement securities) under Article L.513-7 of the French Monetary and Financial Code. These are exposures to credit institutions with a rating of at least “1st stage” (triple A or double A level) or “2nd stage” (single A level), or, where their duration does not exceed 100 days, a rating of “3rd stage” (single A level). The amount of these exposures is limited, according to their rating scale, in relation to the total covered bonds issued by Caffil. This asset class is used for the investment of CAFFIL’s excess cash.

Transfer mode

Caisse Française de Financement Local has implemented various asset acquisition procedures, as follows:

- since early 2013, acquisition of loans marketed by La Banque Postale and granted to French local government entities and public hospitals,

- since the end of 2022, the acquisition of loans marketed by the Caisse des Dépôts (via the Banque des Territoires) and granted to French local authorities and French public hospitals,

- granting to SFIL of loans benefiting from an irrevocable and unconditional guarantee from the French Republic, for the refinancing of large export credits,

- direct origination of loans in connection with the restructuring of loans on its balance sheet,

- investment of cash surpluses in bank or European public sector bonds.

Until the end of 2012 :

- direct loan origination;

- acquisition of loans or securities from Dexia Group companies ;

- granting to Dexia Group entities of loans guaranteed by the assignment of receivables (pursuant to the “Dailly Law” or the “Collateral Directive”).

Financing loans to the local public sector and French public hospitals

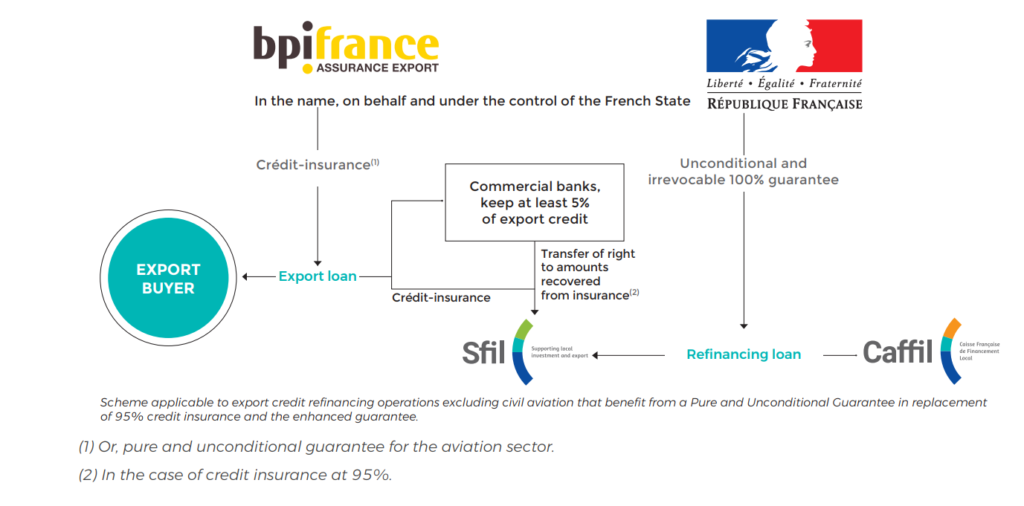

La Banque Postale partnership

Since early 2013, La Banque Postale markets loans to the French local public sector and public hospitals. The loans originated are exclusively in euros with a vanilla interest rate.

Within the framework of this organization for the financing of the French local public sector and public hospitals, Caisse Française de Financement Local and La Banque Postale signed a partnership agreement. La Banque Postale committed to propose to Caisse Française de Financement Local all the loans that would be eligible for its cover pool.

This partnership allows Caisse Française de Financement Local to preserve the control of its credit risk as it organizes the analysis of the credit risk of the loans in two stages.

- When the loan is originated, the initial analysis of the counterparty is carried out simultaneously at the two entities. The loans that do not meet the credit criteria of Caisse Française de Financement Local cannot be transferred to its balance sheet. Caisse Française de Financement Local’s eligibility criteria are strictly monitored by internal management policies and limit eligible counterparties to French local public sector entities and public hospitals.

- Before the loans originated by La Banque Postale are transferred to Caisse Française de Financement Local, a new analysis of the assets is conducted, and Caisse Française de Financement Local may refuse a loan prior to the transfer if the asset no longer meets the criteria.

The sale of loans to Caisse Française de Financement Local is carried out by using a transfer form (bordereau) that is specific to sociétés de crédit foncier.

LBP‑Sfil‑Caisse Française de Financement Local partnership

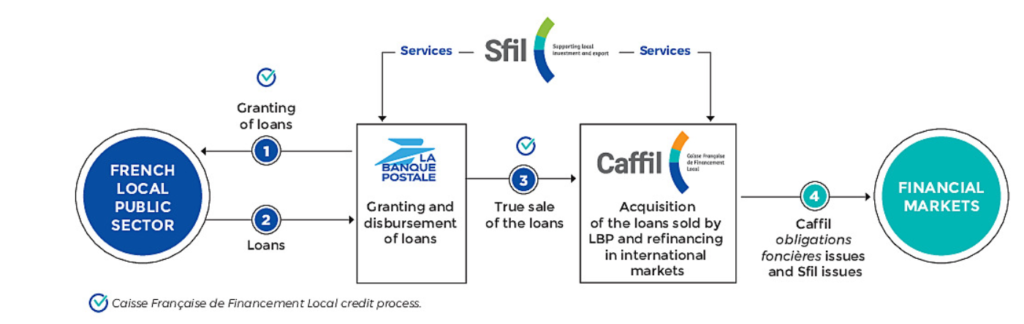

La Caisse des Dépôts partnership

In November 2022, Caisse Française de Financement Local and Caisse des Dépôts (CDC) signed a framework agreement for the sale of receivables to finance the needs of the local public sector and French public hospitals. The system operates as follows:

- The Caisse des Dépôts markets loans to the French local public sector and public hospitals distributed by the Banque des Territoires (BDT), then sells them to Caisse Française de Financement Local, which refinances them by issuing obligations foncières (covered bonds):

- the loans marketed are fixed‑rate loans denominated exclusively in euros and for long terms (generally more than 25 years):

- these loans are mainly intended to finance sustainable investments with an environmental or social purpose.

The operating procedures of this system are comparable to that existing with La Banque Postale.The sale of loans to Caisse Française de Financement Local is carried out by using a transfer form (bordereau de cession) that is provided by law and specific to sociétés de crédit foncier.

CDC‑Sfil‑Caisse Française de Financement Local partnership

Debt management

Within the CAFFIL cover pool, certain loans to French counterparties, inherited from the former shareholder of CAFFIL, are classified as structured loans (cf. charter of good conduct between banking institutions and local authorities available on the website of the Ministry of the Interior). The most sensitive loans were the subject of a desensitization policy conducted by SFIL and CAFFIL, which made it possible to significantly reduce this outstanding amount (nearly 95%). The scope of sensitive structured loans is therefore extremely limited and the associated risk is no longer an issue for the Caisse Française de Financement Local.

CAFFIL may also, for the vanilla assets in its cover pool and at the customer’s request, carry out customer debt management operations (restructuring, extension, etc.).

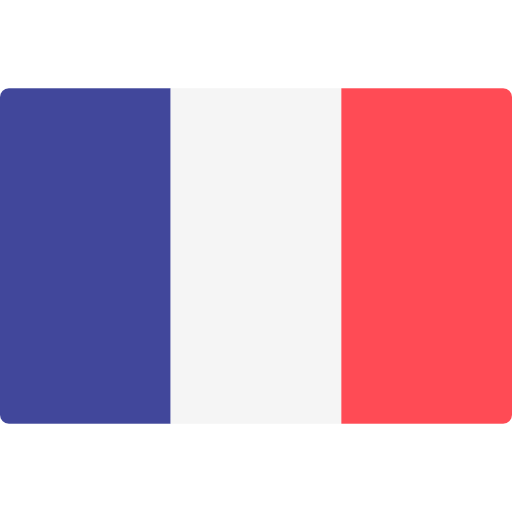

Export refinancing

In addition to their mission of refinancing French local governments and public hospitals, SFIL and Caisse Française de Financement Local have been entrusted with a second mission by the French State: to refinance large French export contracts, with the objective to support French exports in terms of financial competitiveness, in accordance with a public refinancing plan comparable to that of other OECD countries. In this context, SFIL signed a protocol agreement governing relations with about 20 commercial banks, thereby confirming relations with almost all the banks active in the French export credit market. SFIL may acquire all or a part of the participation of each of these banks in an export credit.

In this context, Caisse Française de Financement Local grants loans to SFIL in order to refinance its export credits. Such loans benefit from an irrevocable and unconditional 100% guarantee by the French State (enhanced guarantee). This business brings Caisse Française de Financement Local closer to the French State, without modifying the risk profile of its cover pool.

The system functions as follows:

- SFIL contributes to the financial proposal made by one or more banks in the banking syndicate granting the buyer credit covered by the export credit insurance guaranteed by the French State. Then, these banks will sell all or part of the loans (and the attached rights) to SFIL and will keep at least the share of the export credit not covered by the insurance (usually 5%).

- Caisse Française de Financement Local grants a loan to SFIL to enable it to refinance the acquired export credit. This refinancing loan benefits from either an irrevocable and unconditional 100% guarantee by the French State, referred to as an “enhanced guarantee”, either a so-called “pure and unconditional” guarantee (GPI) by the French State in the case of export contracts for civil aircraft and helicopters. Loans granted by Caisse Française de Financement Local to SFIL to refinance the purchased export credits thus constitute exposures that are totally guaranteed by the French State and eligible for the cover pool of a société de crédit foncier. These loans also comply with the European CRR regulation (article 129, which specifies the assets authorized for inclusion in a cover pool to ensure that the covered bonds will benefit from the best prudential treatment).

The disbursement of refinancing loans for large export credits is staggered over several years as construction of the exported assets and the resulting refinancing needs will progress. These credits, thus, will reach a significant share of CAFFIL’s cover pool only in a few years.

Breakdown of assets by country

French public sector loans made up the majority of CAFFIL’s cover pool and their share is due to increase in the coming years. As a matter of fact, international assets inherited from CAFFIL’s former shareholder are now managed in a run-off mode. Consequently, all new assets entering the cover pool relate to exposures on French public sector borrowers (excepting replacement assets).

Detailed data on CAFFIL’s cover pool composition are available in the key figures section of this internet site and in the quarterly published report on asset quality.

Breakdown of assets by type of counterparty

Caisse Française de Financement Local’s portfolio is very largely made up of exposures on local governments (for about 75%), public hospitals having a share of a little more than 10% of the cover pool. The share of sovereign exposures is due to gradually increase with the release of funds on export refinancings (indirect exposures on French Republic).

Detailed data on CAFFIL’s cover pool composition are available in the key figures section of this internet site and in the quarterly published report on asset quality.

Last update 14/04/2023