Accueil »

Management

Balance sheet

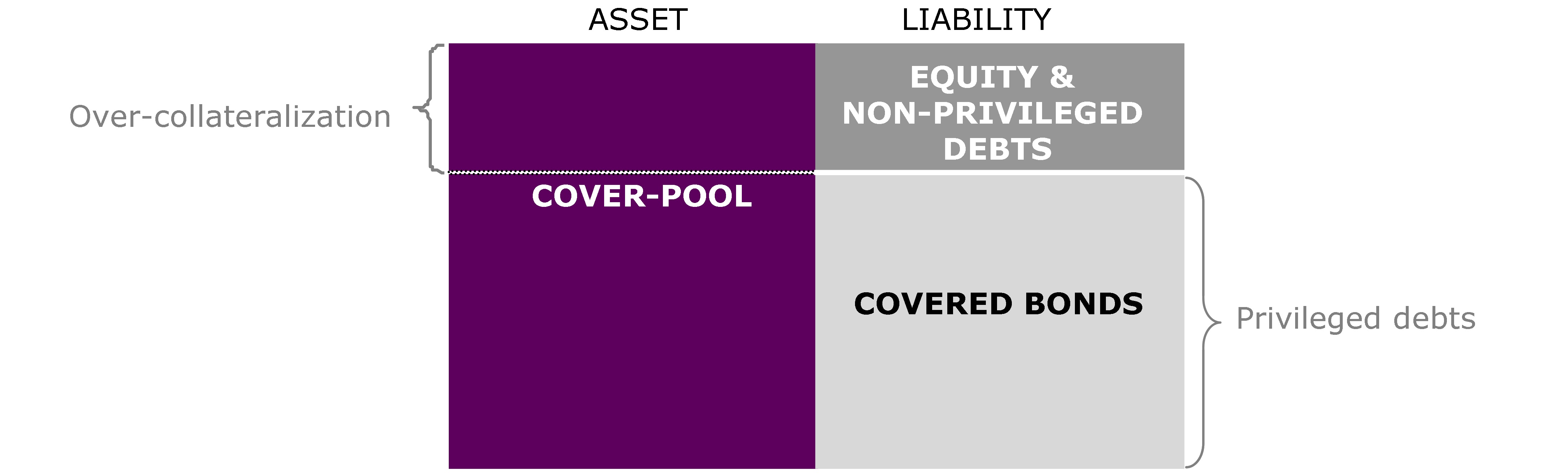

As a société de crédit foncier, Caisse Française de Financement Local’s assets are financed through the issue of debt that is covered by a legal privilege guaranteeing them a priority right on the cash flows generated by the assets.

In addition to its equity, Caisse Française de Financement Local uses two categories of debt to finance its assets:

- debt benefiting from the legal privilege (covered bonds, defined by law as obligations foncières or other resources benefiting from the legal privilege by reason of their contract). Caisse Française de Financement Local thus issues registered covered bonds contractually benefiting from the legal privilege in the same way as obligations foncières;

- debt not benefiting from the legal privilege, which includes debt that is not covered by the assets and which, for this reason, is subordinated vis-à-vis debt benefiting from the legal privilege. Together with equity, it finances the Group’s over-collateralization. It may be of three types:

- mainly, debt negotiated according to the terms of a financing agreement signed with SFIL, CAFFIL’s parent company;

- if necessary, financing obtained from the Banque de France: as a credit institution, CAFFIL is entitled to participate, in its own name, in Banque de France refinancing operations. The financing obtained does not benefit from the privilege provided for by the legislation on sociétés de crédit foncier, but is guaranteed by assets pledged to the Banque de France. These pledged assets are excluded from the cover pool and calculation of the over-collateralization ratio;

- if necessary, financing obtained from credit institutions within the framework of repurchase agreements (repos). As is the case for financing obtained from the Banque de France, this financing is secured by assets pledged in favor of the credit institution. These pledged assets are excluded from the cover pool and calculation of the over-collateralization ratio.

Over-collateralization

The over-collateralization ratio, which is calculated on the basis of regulatory standards governing sociétés de crédit foncier, is the ratio between the assets and the resources benefiting from the legal privilege.

Caisse Française de Financement Local is obliged to maintain a minimum regulatory over-collateralization ratio of 105 %.

The rating agencies may require a higher level of over-collateralization. This requirement depends on the methodology applied and on the new assets and liabilities on Caisse Française de Financement Local’s balance sheet, and it may vary over time. Caisse Française de Financement Local takes these particular requirements into account in the management of its activities, in order to make sure they are always respected.

Information on the CAFFIL’s over-collateralization is available in the key figures section of this website as well as in the quarterly financial and activity reports .

Quality of assets

Caisse Française de Financement Local has endeavored since its creation to ensure that its assets are of excellent quality.

The outstanding loans on CAFFIL’s balance sheet are mainly with public sector counterparties (local and sovereign entity exposures) as well as, more incidentally, bank counterparties (in order to invest its cash surpluses).

French exposures are predominant, accounting for more than 90% of its cover pool. They are diversified in terms of the number of counterparties (around 13,000 different customers), geographical distribution and customer type : regions, departments, cities, municipalities, intermunicipal public institutions, public health institutions and social housing bodies.

New loans granted under the partnership with LBP and the partnership with the Caisse des dépôts (via the Bank of the Territories) as well as arising from CAFFIL’s debt management activity are exclusively with French local public sector borrowers.

Refinancing loans for large export credits benefit from an irrevocable and unconditional 100% guarantee by the French State.

CAFFIL’s outstandings on foreign public sector counterparties account for less than 10% of total outstandings. These exposures are managed in a run-off mode since 2013.

CAFFIL’s low exposure credit risk is reflected in:

- the low level of arrears on its loans,

- its low level of non-performing and litigious loans per French accounting standards (less than 0.5% of the cover pool),

- the near-inexistence of observed losses since SFIL’s inception in 2013.

Information on the quality of CAFFIL’s assets is available in the key figures section of this website as well as in the quarterly financial and activity reports .

Liquidity risk

Liquidity risk is defined as the risk that the institution may not be able to find the necessary liquidity, on a timely basis and at a reasonable cost, to cover the financing needs related to its activity.

Caisse Française de Financement Local’s liquidity risk mainly reflects how able it is to reimburse certain debts benefiting from the legal privilege on a timely basis in the event of an excessive lag between the repayment of its assets and that of its debt benefiting from the legal privilege or a closure of the markets.

Caisse Française de Financement Local has three main types of liquidity need:

- financing of the assets that cover the obligations foncières it issues;

- repayment of debts as they fall due;

- financing of the liquidity requirements related to compliance with regulatory ratios, specific sociétés de crédit foncier ratios and the rating agency methodologies used to meet a rating target

The sources of financing used to meet these requirements, other than the entity’s equity, are:

- debt benefiting from the legal privilege, i.e. obligations foncières, registered covered bonds and cash collateral received;

- refinancing arising from the financing agreement entered into with SFIL to cover the financing requirements related to Caisse Française de Financement Local’s over-collateralization. It relates to the fact that SFIL is responsible for most of the funding requirement associated with Caisse Française de Financement Local’s over-collateralization (the remainder being total equity).

Furthermore, Caisse Française de Financement Local has a large stock of assets eligible for European Central Bank refinancing via the Banque de France.

The aggregate maximum liquidity requirement that Caisse Française de Financement Local could face in the future in a run-off situation in which it was unable to issue new obligations foncières is lower than the maximum funding already occasionnely obtained on a one-off basis from the central bank in the past. It is also lower than the Caisse Française de Financement Local’s refinancing potential with the Banque de France, measured by the amount of eligible assets after haircut that would be available while complying with the minimum over-collateralization required by the regulations.

Caisse Française de Financement Local has its own autonomous resources that enable it to cover its temporary liquidity needs, even in the event of the default of its parent company, since any legal proceedings engaged for the bankruptcy or liquidation of its parent company cannot be extended to Caisse Française de Financement Local (article L.513-20 of the Monetary and Financial Code).

To control its liquidity risk, Caisse Française de Financement Local relies mainly on static, dynamic and stressed liquidity forecasts in order to ensure that the liquidity reserves at its disposal in the short and long term will be able to cope with its commitments.

Dynamic liquidity forecasts take into account business assumptions (new assets and new financing), under normal and stressed conditions:

- under normal conditions, these forecasts aim to define the amounts and maturity of the various sources of financing that may be raised by Caisse Française de Financement Local;

- under stressed conditions, these forecasts aim to assess the resilience of Caisse Française de Financement Local to a liquidity shock and to determine its survival horizon.

Caisse Française de Financement Local also manages its liquidity risk by monitoring and ensuring compliance with:

- the regulatory indicators specific to sociétés de crédit foncier (regulatory coverage ratio / over-collateralization ratio, weighted average term gap and projected cash requirements at 180 days),

- the regulatory liquidity indicators applicable to credit institutions, in particular the liquidity coverage ratio (LCR) and the net stable funding ratio (NSFR).

- internal indicators (stressed and unstressed short- and long-term liquidity projections, management coverage ratio / over-collateralization ratio, duration gap between assets and liabilities benefiting from the legal privilege, one-year survival horizon in stressed conditions, sensitivity of the net present value of the static liquidity gap, etc.).

Information on CAFFIL’s liquidity risk management is available in the key figures section of this website as well as in the quarterly financial and activity reports.

Interest rate risk

Interest rate structural risk is defined as the risk of loss incurred in the event of a change in interest rates that would lead to a loss in value of balance sheet and off-balance sheet transactions, excluding any trading portfolio transactions. Since Caisse Française de Financement Local does not have a trading portfolio, it is not concerned by this exception.

There are four types of interest rate (fixed interest rate risk, basis risk, Fixing risk and option risk).

Caisse Française de Financement Local has defined an appetite for fixed interest rate risk of EUR 80 million, to limit its impact, Caisse Française de Financement Local implements an interest rate risk hedging strategy consisting of :

- micro-hedging of interest rate risk on balance sheet items denominated in a currency other than the euro or indexed to a complex interest rate structure. Certain euro-denominated vanilla transactions may also be micro-hedged if their notional value or duration could lead to a sensitivity limit being exceeded. Micro-hedging is carried out exclusively by swap;

- macro-hedging of interest rate risk for all transactions that are not micro-hedged. The transactions concerned are mainly (i) loans to the local public sector and (ii) issues of obligations foncières denominated in euros. This macro-hedging is obtained as far as possible by matching fixed-rate assets and liabilities via the termination of swaps and, for the rest, by setting up new swaps against Euribor or €str;

This management of fixed-rate risk is complemented by monitoring the fixings of revisable rate transactions to ensure that they do not exceed the short-term sensitivity limit. Where applicable, swaps against €ster may be entered into to hedge the fixing risk.

These hedges can be made either directly on the market by the Caisse Française de Financement Local, or be intermediated by SFIL, which then turns on the market.

Non-privileged debt is not covered. Indeed, the debts contracted by the Caisse Française de Financement Local with its shareholder to finance the oversizing are borrowed either directly with a €str index and do not need to be swapped, or with a Euribor index and then finance assets also indexed to Euribor. Where applicable, debts to the Bank of France, short-term and fixed-rate, are not covered, but also finance fixed-rate assets.

These different types of interest rate risks are monitored, analyzed and managed through the monitoring of fixed rate, index and fixing impasses, calculated in static vision.

Asset portfolios whose strategy is to be fully hedged are not sensitive to changes in rates and are therefore not included in the calculation of the overall sensitivity of the Caisse Française de Financement Local’s balance sheet.

The rate risk management system is mainly based on the economic risk indicator (sensitivity of the net present value (NPV): the measure of this risk is equal to the maximum net present value loss (NPV) observed in relation to eight different rate scenarios. These eight scenarios correspond to the six scenarios in the calculation of the “outlier” regulatory ratio, to which are added two additional internal scenarios defined on the basis of historical variations in rates.

Information on CAFFIL’s interest rate risk management is available in the quarterly financial and activity reports.

Foreign exchange risk

The foreign exchange risk is defined as the risk of recorded or unrealized earnings volatility, linked to a change in the exchange rate of currencies vis-à-vis a reference currency. Caisse Française de Financement Local’s reference currency is the euro: the foreign exchange risk therefore reflects the change in the value of assets and liabilities denominated in a currency other than the euro, due to a fluctuation of the latter against the euro.

Caisse Française de Financement Local’s foreign exchange risk management policy is to incur no foreign exchange risk: it enters into cross‑currency swaps against the euro for its issues and assets denominated in foreign currency, on initial recognition at the latest and until their final maturity, thereby ensuring that these balance sheet items’ principal and interest rates are hedged. Floating rate exposures in euros generated by this management policy are incorporated into interest rate risk management.

Foreign exchange risk is monitored using the net foreign exchange position in each currency, calculated on all foreign currency balance sheet receivables, debts (including accrued interest not yet due) and off‑balance sheet commitments. The net foreign exchange position per currency must be zero, with the exception of USD, GBP and CHF, in which a marginal position is tolerated for operational reasons.

Nonetheless, certain loans to refinance large export credits denominated in foreign currency may cause a very limited temporary foreign exchange risk during their drawing phase in case of a shift between effective drawing dates and those initially scheduled and hedged. This residual risk is controlled by a very low sensitivity limit on the euro/currency basis,calculated over the life of the loans.

Information on CAFFIL’s foreign exchange risk management is available in the quarterly financial and activity reports.

Last update 17/04/2023