Accueil » Presentation »

Rating

Financial ratings

The ratings of the bonds issued by Caisse Française de Financement Local are at the highest level of credit quality (Step 1). This requires that the quality of the cover pool and strict management rules be consistent with the criteria and approaches*.

| Moody’s | DBRS | |

| Rating | Aaa | AAA |

| Outlook | – | – |

| Published in | March 2025 | February 2025 |

| Minimum over-collateralization for current rating | 11.5 % | 5.0 % |

| Last published report | March 2025 | September 2024 |

| Other information | Rating affirmed | Rating affirmed |

*This rating involves :

- a quarterly review of assets,

- an agreement on the principles and the policy of hedging interest rate,

- the satisfaction of stress scenarios and extinguishment of the balance sheet,

- an appreciation of the relationship Caisse Française de Financement Local – sponsor bank, SFIL.

The specific management rules of Caisse Française de Financement Local provide additional security for investors who benefit from the legal privilege.

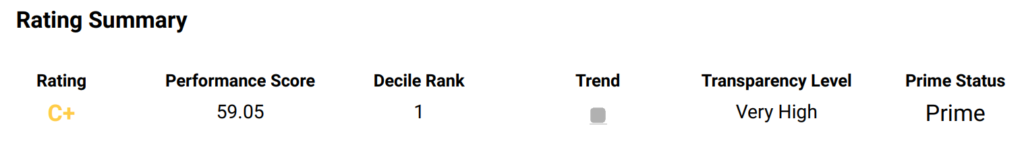

Extra-financial ratings

Caisse Française de Financement Local is rated by ISS.

ISS considers that CAFFIL’s risks appear to be limited, as its funds are primarily allocated to France, with its fairly high social and environmental standards.

Last update 21/03/2025