Accueil » Presentation »

Profile

Description and Missions

Caisse Française de Financement Local ( also known by its acronym CAFFIL) is a specialized credit institution authorized to operate as a société de crédit foncier. Its sole business is the refinancing of loans to public sector entities through the issue of covered bonds, called obligations foncières. CAFFIL is fully owned by the French State-owned public development bank SFIL.

Caisse Française de Financement Local and its parent company SFIL have been tasked by the French State:

- to finance loans to the French local governments and public hospitals granted by La Banque Postale and by la Caisse des Dépôts (via la Banque des Territoires)

- to refinance large export credits with the unconditionnal and irrevocable guarantee of the French State.

Licence : Authorization by the CECEI (in French)

See our Articles of incorporation

Shareholding structure

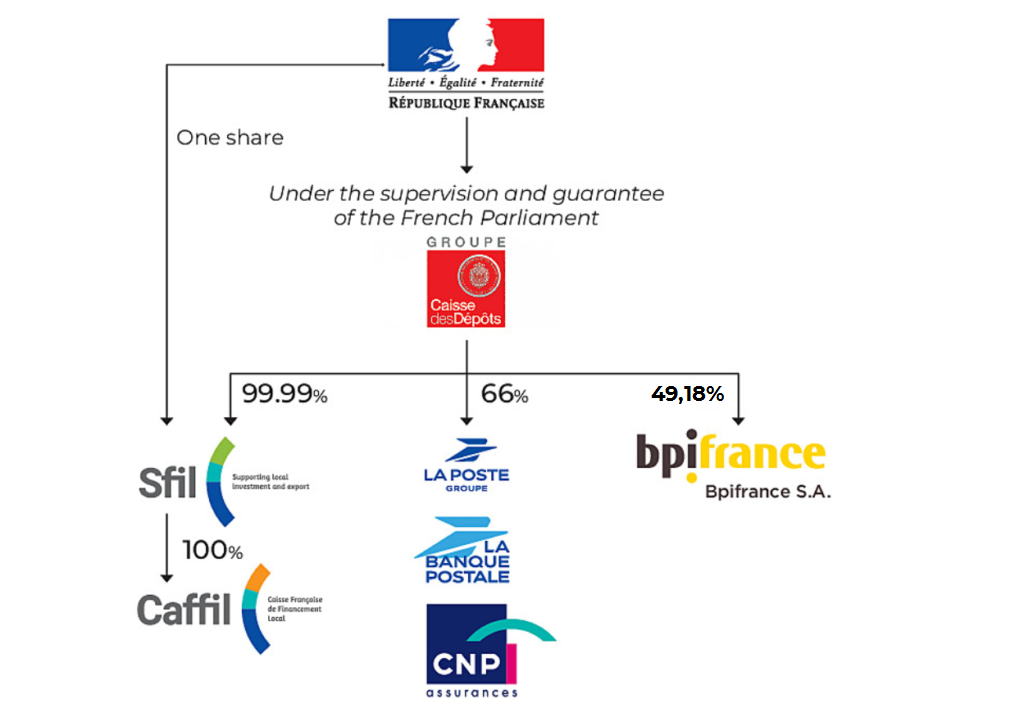

The capital of Caisse Française de Financement Local is 100% held by SFIL. SFIL is a public development bank, financial institution approved by the Autorité de contrôle prudentiel et de résolution (ACPR). Its shareholder is the Caisse des Dépôts (99.99%). The French State holds one ordinary share. SFIL’s shareholders are thus firmly anchored in the public sphere, reflecting the missions the French State assigned it.

The Caisse des Dépôts is the “reference shareholder” of SFIL and Caisse Française de Financement Local for ACPR, underlining its commitment to ensure oversight and to influence strategic decisions, as well as its determination to ensure Caisse Française de Financement Local’s and SFIL’s ongoing fnancial transactions and to comply with regulatory requirements, if so required.

SFIL and the Caisse Française de Financement Local thus participe to the major public financial group based on Caisse des Dépôts and La Poste.

SFIL

SFIL, as the parent company of Caisse Française de Financement Local assumes the following responsibilities:

- Servicing

In accordance with the regulations applicable to sociétés de crédit foncier and in particular article L.513-15 of the French Monetary and Financial Code, CAFFIL must contract out its management to a third-party credit institution – SFIL in its case. - Liquidity provider

SFIL provides the funding not benefiting from the legal privilege that Caisse Française de Financement Local needs to finance its over-collateralization within the framework of a financing agreement signed between the parties. In addition, on January 31, 2013 SFIL signed a statement of support in CAFFIL’s favor. - Swap counterparty

SFIL provides CAFFIL with some of the risk hedging derivatives required for its activity.

Supervisory Board and Executive Board

The Executive Board is in charge of Caisse Française de Financement Local’s management and administration.

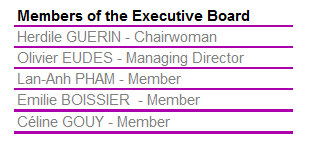

EXECUTIVE BOARD SINCE NOVEMBER 1st, 2023

The Supervisory Board exercises permanent control over the Executive Board’s management of the Company.

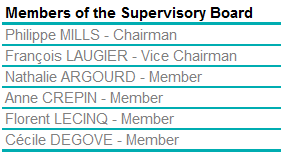

SUPERVISORY BOARD SINCE FEBRUARY 15, 2024

Last update 12/03/2024